If you are considering purchasing a home this year but are waiting for rates to drop, you need to reconsider that plan. According to experts, we are not going to see 3% rates any time soon however, with inflation easing we will see lower mortgage rates in 2023 as compared to this past year. This is still a great time to buy and homeownership is still a better option over renting!

During the pandemic, second homes became popular because of the rise in work-from-home flexibility. That’s because owning a second home, especially in the luxury market, allowed those homeowners to spend more time in their favorite places or with different home features. Keep in mind, a luxury home isn’t only defined by price. In a recent article, Investopedia shares additional factors that push a home into this category: location, such as a home on the water or in a desirable city, and features, the things that make the home itself feel luxurious.

It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than explaining them each in depth, let’s lean on the experts and what history tells us to see what could lie ahead. As Greg McBride, Chief Financial Analyst at Bankrate, says:

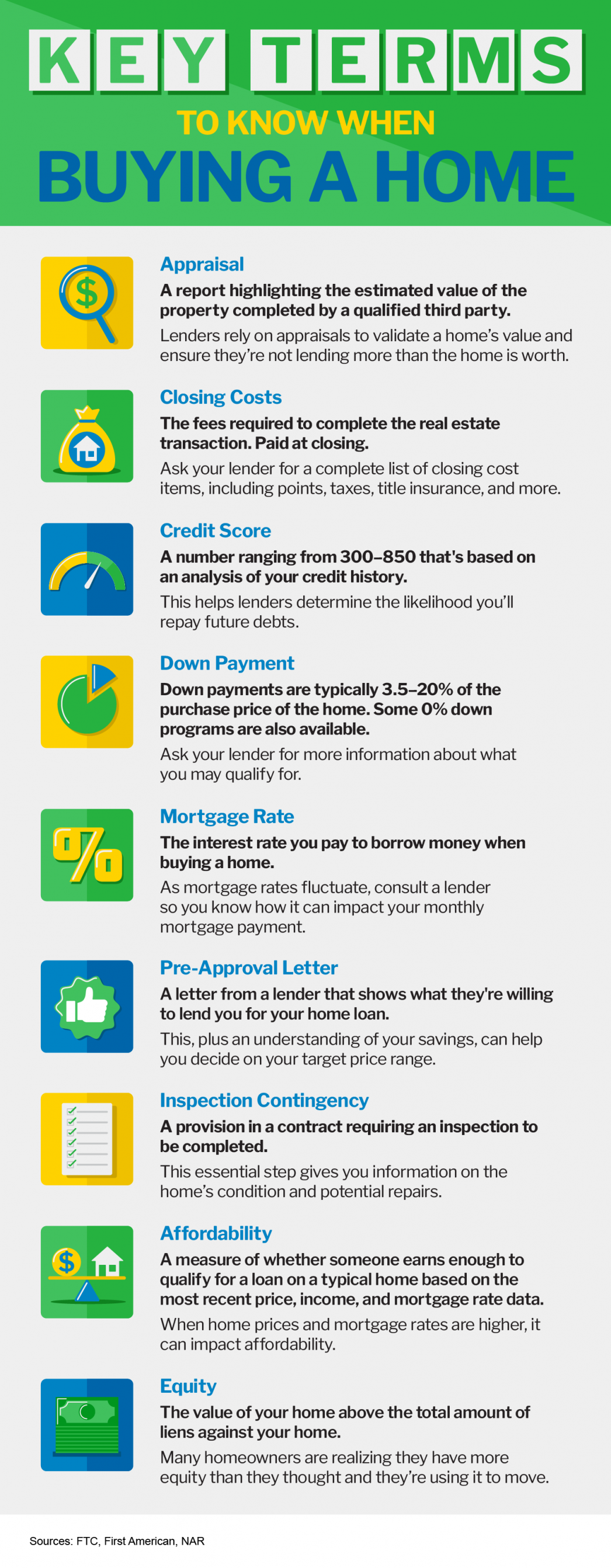

Are you considering buying a home in 2023 and overwhelmed with all the terminology? Here are 9 Key Terms to help you better navigate through the homebuying process.

If you were considering buying a home or selling a home in 2022 you probably felt like you had the rug ripped out from under you, with constant rate hikes and so much uncertainty in the market. The good news is that experts are predicting greater stability and predictability in the housing market for 2023. If you held off on buying your dream home or selling your home this past year, 2023 may be your year!

Mortgage Rates have been at the top of everyone's mind this past year and many prospective buyers have continued to hold off on a home purchase until things simmer down. But, while you are waiting for rates to drop and getting ready to sign another rental lease, consider the fact that rents between 2021 and 2022 increased by over 17% and are expected to increase by another 6% or more in 2023. Over a 20% increase in 3 years! Read further to find out why you need to consider a home purchase in 2023.

I hear from so many clients that they are not ready to buy a home because they need to "save more money". My advice is always to contact a local Lender and find out what your options are. There are many loan programs that require very little money for down payment as well as programs that offer cash assistance to first time homebuyers who meet certain criteria. With so much available you may find that you are indeed ready to buy your first home!

If you are thinking about buying or selling this year, here are 3 important questions to ask yourself.

You have obtained mortgage preapproval from your Lender and just gone under contract for the home of your dreams. Now all you need to do is wait until the closing! Sounds easy right? It can be, provided you do exactly what your Lender advises. Lenders will pull an update of your credit report days before your scheduled closing. They will also reach out to your employer to verify that you are still employed. Any changes you make to your credit or employment/income from preapproval until closing could have negative consequences and ultimately you could end up losing out on that dream home. Here are 6 things you should NOT do to ensure a successful closing.

| Newer Posts | Older Posts |