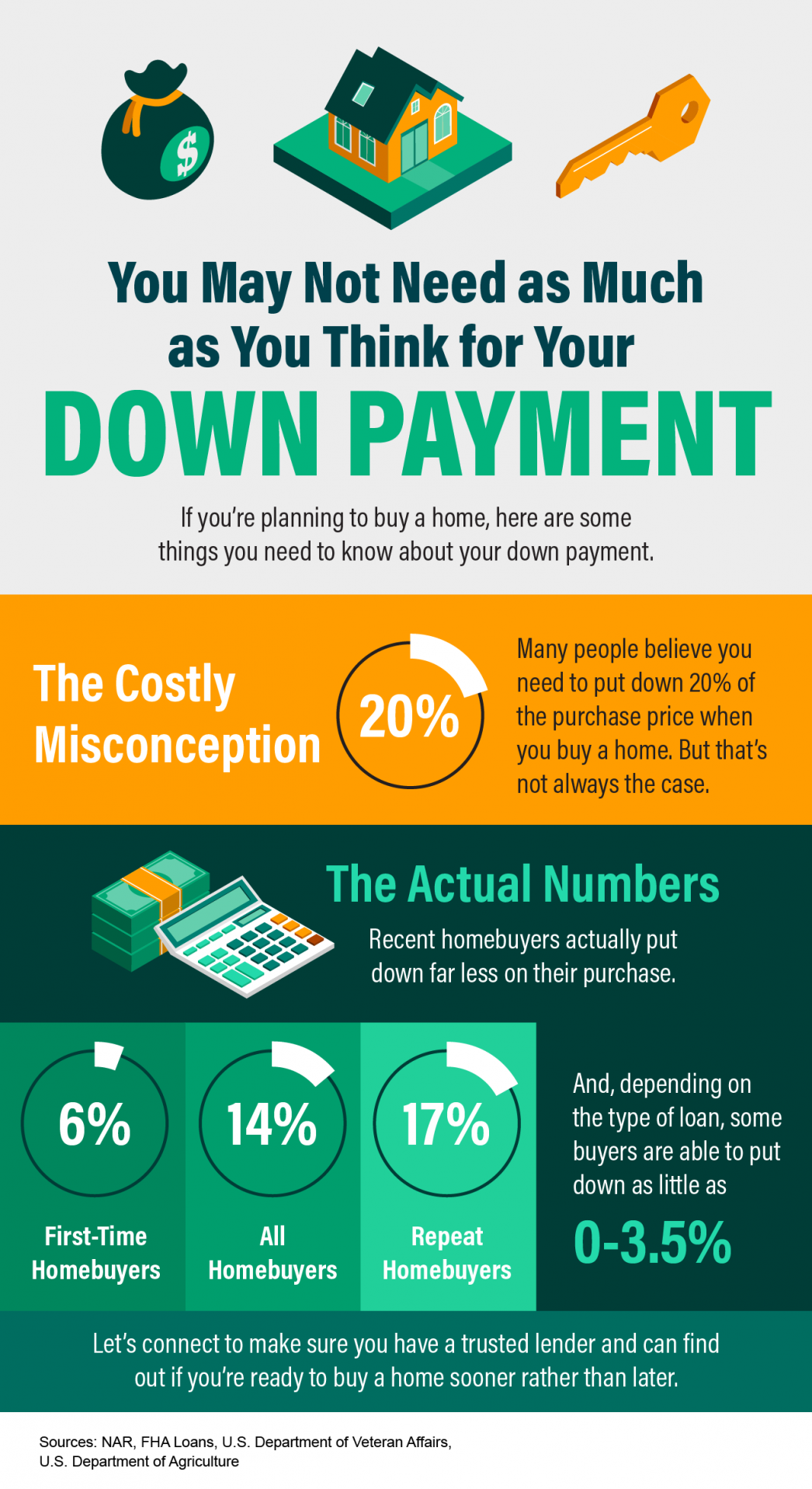

In talking to people about their home buying goals many say that, although they would love to buy their first home, they just don’t have enough money saved. But how much does one need to save in order to buy a home? There is a misconception out there that you need to have at least 20% of the purchase price saved for a down payment. And that does not even factor in the closing costs. With the price of today’s homes, that is an overwhelming amount of money for anyone! The good news is that with the variety of loan programs available now, you could get into a home with as little as 0-3.5%. You may be surprised to find out that you DO have enough money saved to purchase a home now.

If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they’re an investment that’s gained popularity in recent years. According to a Harris Poll survey, 28% of homeowners have considered using a rental service to temporarily rent out their home for additional income.

I love the charm and uniqueness of an older home although renovating one, as I have come to find out, can be challenging! Sometimes I wonder what it would have been like if I had started from scratch and built something. Either way I would have made it my own. If you are looking to sell this year and wondering where to go, here are 4 great reasons to buy an existing home and 4 great reasons to buy a new home. You decide which is right for you!

Let's face it, no one wants to look at homes in the middle of winter in New Hampshire, let alone move! If you are planning to purchase a home this year you are probably among the many waiting for the Spring Market to roll in. Contrary to popular opinion, NOW may be a better time to start your homebuying search. Read on to find out why:

“Is this a good time to buy a home?” The answer is, “Absolutely!" There are 3 key elements in the housing market that determine affordability, Mortgage Rates, Home Prices and Wages. Experts are predicting that these 3 factors are likely to improve this year! Read on to find out more:

Getting top dollar for your home does not always mean pricing it as high as possible. There are many factors to consider when pricing your home to sell and it is important to understand the “method behind the madness”. Pricing your home too high could result in less money than the home is worth, while pricing too low could result in money being left on the table. This is why it is so important to work with a Real Estate Professional who can help you navigate through all these caveats. Contact me today!

I hear the same question from buyers over and over, “I want to buy a house but I don’t know where to start?” THE most important first step in buying a home is not to start looking at houses but to obtain a preapproval from a local lender. Without a preapproval, you have NO idea what your purchase power is and are not fully prepared to start making offers on homes that you may fall in love with. Do not put off this important step in the process!

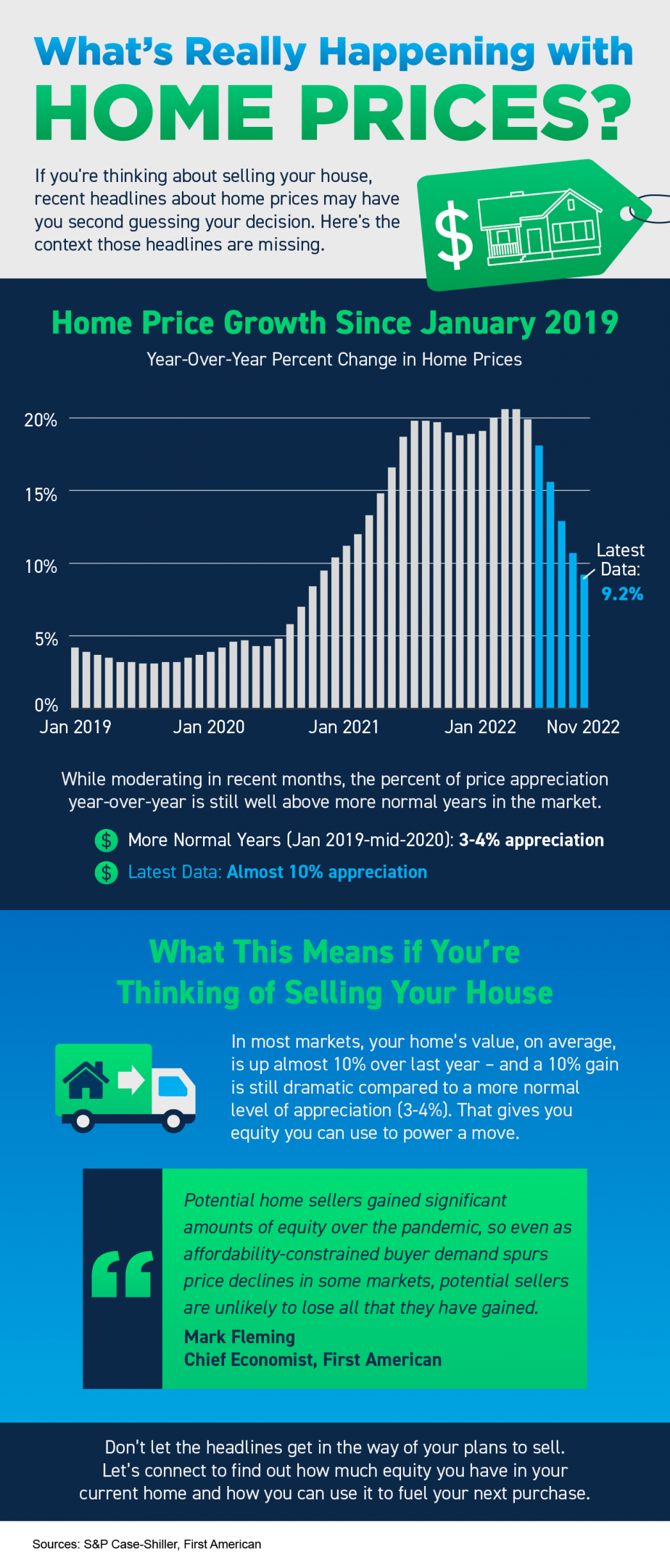

Don't Let The Headlines Get In The Way Of Your Plans To Sell In 2023

| Newer Posts | Older Posts |