Homeownership as a Wealth Building Tool

If you are still on the fence about buying a home versus continuing to rent, this article may help you gain some perspective in favor of buying. Clearly this past year has been tough for first time homebuyers, with multiple offer situations, over bidding and interest rates climbing, many of you are probably thinking buying a home now just isn't worth it. However, studies are now showing that there is a huge wealth gap between renters and homeowners (in favor of homeowners) over time. Read further to find out why:

Homeownership Is an Investment in Your Future

There are many people thinking about buying a home, but with everything affecting the economy, some are wondering if it’s a smart decision to buy now or if it makes more sense to wait it out. As Bob Broeksmit, President and CEO of the Mortgage Bankers Association (MBA), explains:

“The desire for homeownership is strong. Many prospective buyers are waiting for the volatility in mortgage rates to subside, as well as for a clearer picture of the economic outlook.”

If you’re in that position, remember that it’s important to consider not just what’s happening today but also what benefits you may gain in the long run.

There’s a lot of information out there about how homeownership helps build a homeowner’s net worth over time. But even today, many people think first about things like 401(k)s before they think of owning a home as a wealth-building tool. It’s especially important if you’re a young prospective homebuyer to understand how homeownership is another key way to invest in your future. An article from Bloomberg notes:

“Millennials have higher average 401(k) balances than Generation X did when they were the same age, but they're not any better off financially. . . . A lot of that has to do with being less likely to own a home.”

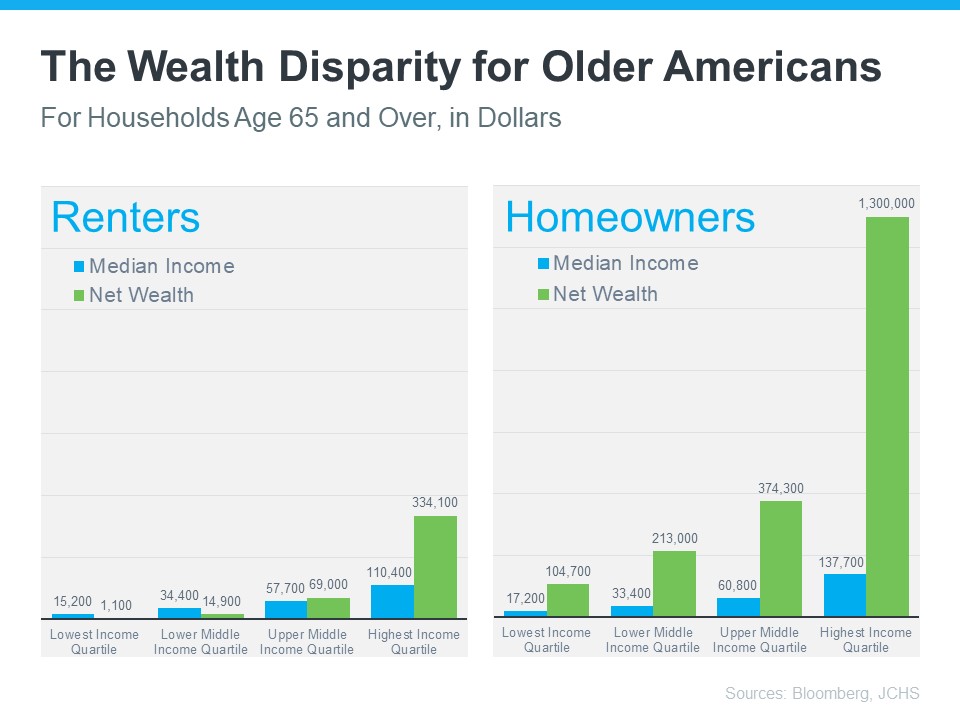

To help you understand just how much owning a home can have a positive impact on your life over the years, take a look at what the data shows. The same Bloomberg article helps show the gap in wealth between renters and homeowners who are 65 years and older (see graph below). The difference is substantial, even when incomes are similar.

So, if you want to create wealth to help set you up for success later on, it may be time to prioritize homeownership. That’s because, whether you decide to rent or buy a home, you’ll have a monthly housing expense either way. The question is: are you going to invest in yourself and your future, or will you help someone else (your landlord) increase their wealth?

Bottom Line

Before putting your homeownership plans on hold, let’s connect to go over your options. That way, you’ll have expert advice on how to make the best decision right now and the best investment in your future.

Share This Post

| Previous Post | Next Post |